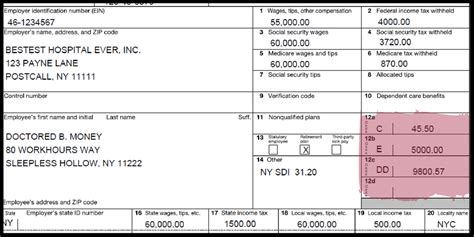

box 12 on w2 emploee health distribution According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also .

For All Your Metal Needs: From Design To Manufacturing. Over the past several decades, we have become the go-to shop in the area for custom and light-production metal fabrication. We are able to take your job from conception to completion.

0 · w2 health insurance contributions

1 · w2 box 12 medicare

2 · w2 box 12 health insurance

3 · w2 box 12 contributions

4 · w2 box 12 code

5 · w2 box 12 401k

6 · w 2 box 12 hsa

7 · box 12 health insurance contributions

Splices should be in a water proof junction box - in fact all permanent junctions should be in junction boxes. To ensure that the splice is water proof I pack it in duck seal then rubber tape then vinyl tape.

Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, .

Jun 5, 2024 W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. .The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to .

According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also . Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:

w2 health insurance contributions

Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes. Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.

Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD. Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts. W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.

The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) plan

According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA. Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes.

Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts. W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) plan

According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA.

Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.

w2 box 12 medicare

United Machine & Metal Fab, Inc. is a leading manufacturing company based in Conover, NC, specializing in CNC machining, EDM services, surface grinding, and inspection. They are dedicated to maintaining exceptional quality standards and are always seeking high-quality individuals to join their team.

box 12 on w2 emploee health distribution|box 12 health insurance contributions