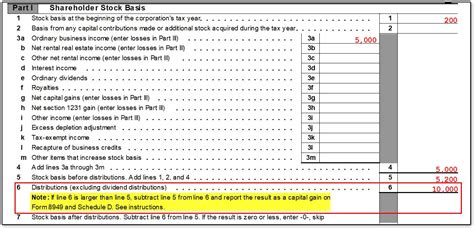

box 3 non dividend distribution Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of . Maintenance-free terminals: these are new types of junction terminals which are clamped, pushed or inserted to secure their various parts rather than screwed on. They are intended as an easy, stress-free solution for junction boxes located in ‘inaccessible’ areas. Types of Junction Boxes

0 · non dividend distributions 1040

1 · non dividend distributions

2 · non dividend distribution reporting

3 · non dividend distribution form

4 · box 3 non dividend

5 · box 3 dividend distributions

6 · 1099 box 3 nondivided distribution

7 · 1099 box 3 dividend distribution

Have you ever noticed a star adorning the exterior of a house and wondered about its significance? These stars are seldom the same, often seen in various colors, sizes, and materials — they are not just decorative elements; they carry a wealth of history and meaning.

Learn more about nontaxable distributions, which should be reported on Form 1099-Div Box 3. H&R Block’s tax pros explain everything you need to know . Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of . The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear .

When you receive a Form 1099-DIV indicating non dividend distributions in Box 3, you should report this amount on your tax return. Consult the IRS guidelines and instructions for Form 1099-DIV to ensure accurate .

A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is . Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form. The investor may receive.A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing .

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states . Box 3: Non-Dividend Distributions. These are distribution in excess of the company’s earnings (including any retained earnings from previous years) and in excess of any realized capital.Learn more about nontaxable distributions, which should be reported on Form 1099-Div Box 3. H&R Block’s tax pros explain everything you need to know about investment income. How Does A Non Dividend Distribution Get Reported? If this type of distribution is given to you, then you should also receive a statement, or more commonly a Form 1099-DIV. A non dividend distribution will be shown in Box 3 on this form.

Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of your original investment.

non dividend distributions 1040

The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear anyplace on your tax return (Form 1040 or elsewhere). When you receive a Form 1099-DIV indicating non dividend distributions in Box 3, you should report this amount on your tax return. Consult the IRS guidelines and instructions for Form 1099-DIV to ensure accurate reporting and compliance with tax laws.

how to locate distribution box on septic

A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained. Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form. The investor may receive.A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a .

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states that a nondividend distribution is a distribution that is not paid out of . Box 3: Non-Dividend Distributions. These are distribution in excess of the company’s earnings (including any retained earnings from previous years) and in excess of any realized capital.Learn more about nontaxable distributions, which should be reported on Form 1099-Div Box 3. H&R Block’s tax pros explain everything you need to know about investment income.

non dividend distributions

How Does A Non Dividend Distribution Get Reported? If this type of distribution is given to you, then you should also receive a statement, or more commonly a Form 1099-DIV. A non dividend distribution will be shown in Box 3 on this form. Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of your original investment.

The answer to your question is that a nondividend distribution (one, or more, it doesn't matter) actually won't affect your taxes at all this year and won't directly appear anyplace on your tax return (Form 1040 or elsewhere). When you receive a Form 1099-DIV indicating non dividend distributions in Box 3, you should report this amount on your tax return. Consult the IRS guidelines and instructions for Form 1099-DIV to ensure accurate reporting and compliance with tax laws.

A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained.

Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form. The investor may receive.A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a .

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states that a nondividend distribution is a distribution that is not paid out of .

non dividend distribution reporting

how to make a cigar box guitar electric

how to install steel stud electrical boxes

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently.

box 3 non dividend distribution|1099 box 3 nondivided distribution