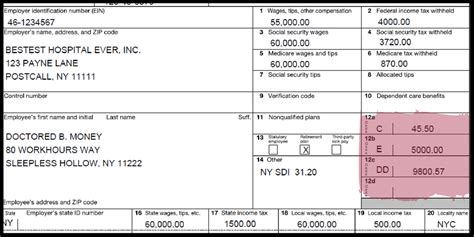

box 12 on w2 emploee health distribution W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. We are ramping up our Kingdom Metal Works YouTube Channel with our first Metal Shaping workshop. This video will demonstrate old-school techniques in metal shaping for the beginner to advanced using hand tools and machinery that is common in fabricator/restoration shops and home shops.Metal detecting around an old house built in 1951. I made an unexpected discovery that predates the house by nearly 100 years!

0 · w2 health insurance contributions

1 · w2 box 12 medicare

2 · w2 box 12 health insurance

3 · w2 box 12 contributions

4 · w2 box 12 code

5 · w2 box 12 401k

6 · w 2 box 12 hsa

7 · box 12 health insurance contributions

$26.99

Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, . Jun 5, 2024

W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. .The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to .

According to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also . Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes.

Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts. W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included. If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.

The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) planAccording to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA.

Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.Box 12 — Various Form W-2 codes on box 12 reflect different types of compensation or benefits. This is one of the more complex W-2 boxes, with codes ranging from A to HH. Gain more insight into W-2 box 12 codes.

w2 health insurance contributions

Reporting on the Form W-2. Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2 PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees.Individuals (employees) do not have to report the cost of coverage under an employer-sponsored group health plan that may be shown on their Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

mustang 50th anniversary metal box

Each year, you need to file Form W-2 for your employees. You might need to use Form W-2 Box 12 codes to accurately fill out Form W-2. If you are not familiar with Box 12, there are currently 26 codes to report certain compensation and benefit amounts. W2, box 12, code DD shows how much your employer-sponsored health insurance plan costs. It's not taxable income. Here is what is included.

If you offer your health stipend on a reimbursement basis, you can withhold taxes on your employees’ W-2 as imputed income. You can report imputed income on Form W-2 in Box 12 using Code C and Boxes 1, 3, and 5. Employers must also withhold Social Security and Medicare taxes for stipends.The UPPER-CASE (capital) letters in box 12 report different things to the IRS. Here's a list of what each one means. Box 12 codes. A: Uncollected social security or RRTA tax on tips reported to your employer; AA: Designated Roth contributions under a section 401(k) planAccording to the W-2 instructions from the IRS, the following list explains the codes shown in box 12 on the W-2: Elective deferrals to a section 401 (k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401 (k) arrangement. Employer contributions to your Archer MSA. Box 12 on your W-2 form reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount. Here’s what those codes mean:

Read more as we outline the instructions for box 12 on a W-2 form to help you as you compute income tax on your wages, whether they’re from your paycheck, state wages, Medicare wages, Social Security wages, or otherwise.

w2 box 12 medicare

w2 box 12 health insurance

What would y’all recommend I do to get a better signal inside the metal building? Metal outbuildings are always a challenge. Rain is also a negative factor as far as signal range. This question has come up several times in the past, and it often comes down to specific small details about set up.

box 12 on w2 emploee health distribution|box 12 health insurance contributions