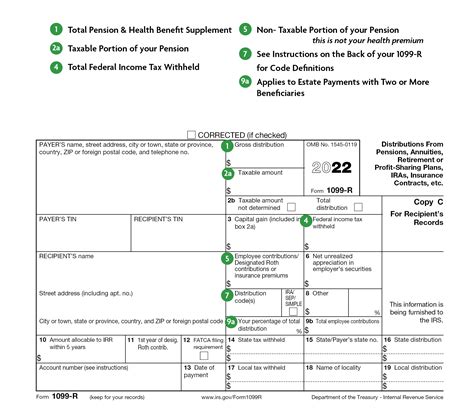

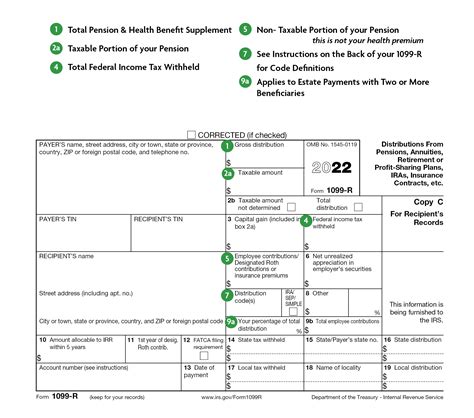

1099-r box 1 gross distribution Boxes 1 through 9. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account .

The metal part is what will become encased in acrylic inside the denture. The black part is a weak male attachment used to snap into the Locator abutment during processing. The white ring just fills in any space between the metal collar and the abutment to keep acrylic from flowing where it doesn’t belong.

0 · what is csa 1099 r

1 · is a 1099 r taxable

2 · 1099 taxable amount not determined

3 · 1099 r taxable amount

4 · 1099 r reporting requirements

5 · 1099 r explained

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

Septic tank distribution boxes, also known as D-boxes, are a crucial component of any septic system installation. This comprehensive guide will explain what they are, how they work, why proper distribution is important, signs of a failing D-box, and steps for inspection, maintenance, and replacement.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Information about Form 1099-R, Distributions From Pensions, Annuities, .

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early . Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .

I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check . Boxes 1 through 9. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account .

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is .Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the main boxes to . IRS Form 1099-R reports income received from IRAs, pensions, retirement plans, profit-sharing plans, insurance contracts, and annuities. Whether you're required to pay taxes .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

customized turn-milling compound machining parts

what is csa 1099 r

I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250). Boxes 1 through 9. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following:

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the main boxes to pay attention to: Box 1: Gross distribution — This is the total amount of money you received from your retirement account during the tax year before taxes.

IRS Form 1099-R reports income received from IRAs, pensions, retirement plans, profit-sharing plans, insurance contracts, and annuities. Whether you're required to pay taxes on this income depends on the source. Distributions from a traditional 401 (k), for example, are usually taxable. Distributions from a Roth IRA may be tax-free.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250).

Boxes 1 through 9. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following:

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

is a 1099 r taxable

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan. The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the main boxes to pay attention to: Box 1: Gross distribution — This is the total amount of money you received from your retirement account during the tax year before taxes.

customized plastic machining parts

Hi, I have a solar array on top of a residence. The city requires a roof top ac disconnect. The array usually have a junction box to make all the splice connections then go into a ac disconnect. Is it possible to avoid the junction .

1099-r box 1 gross distribution|1099 r taxable amount