cash liquidation distribution box 9 lacerte If your client receives a cash liquidation distribution, you have to find out the . The issue I have is that the wire is not long enough (about 4-6 inches short) to reach the junction box used by the old oven. So I was planning on connecting a wire to the old junction box and add another junction box closer to the oven and connect the wire from the oven to that junction box.

0 · liquidation distribution proceeds

1 · line 9 cash liquidation distribution

2 · cash liquidation distributions

3 · cash liquidation distribution form

4 · Lacerte box 1099

5 · Lacerte 1099 div box 9

6 · 1099 liquidation distributions

If your house has visible wiring splices or if you need to add a new splice to extend a circuit, follow these simple steps to install a junction box.

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction.Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in .If your client receives a cash liquidation distribution, you have to find out the .Liquidation distributions, reported on Form 1099-DIV, are distributed when a .

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule .

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The .

mounting junction box under floor joist

1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market .

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these .Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in . Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see .

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in .

You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable . Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock.1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest?

Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments. Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see here. Exempt-Interest Dividends (box 11), see here.

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment. You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock .

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

liquidation distribution proceeds

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock.1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 8) from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest? Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

mount new light fixture to old junction box

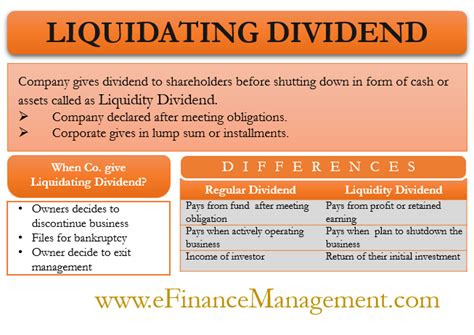

Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. These distributions are, at least in part, one form of a return of capital. They may be paid in one or more installments.

Some boxes don't have direct inputs in Lacerte. If you need assistance entering: Cash liquidation distributions (box 9), see here. Noncash liquidation distributions (box 10), see here. Exempt-Interest Dividends (box 11), see here.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

line 9 cash liquidation distribution

cash liquidation distributions

Wireless fuse boxes - helper block that adds: - all the control panel blocks act as fuse boxes. - a paint-able block as fuse box. - adds all 4 conduit models as fuse boxes. - 2 switch variants : the blue fuse box and a top control panel model.

cash liquidation distribution box 9 lacerte|cash liquidation distributions