cash liquidation distributions box 9 lacerte If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final .

In this video, we'll teach you the basics of wiring a metal box, including the different types of connectors you need to use and the precautions you should take when wiring a metal box.

0 · liquidation distribution proceeds

1 · line 9 cash liquidation distribution

2 · how to report liquidation distribution

3 · cash liquidation distributions

4 · cash liquidation distribution form

5 · Lacerte box 1099

6 · Lacerte 1099 div box 9

7 · 1099 liquidation distributions

【Solved】Click here to get an answer to your question : What device stores charge on two parallel metal sheets? A. A wire B. A resistor C. A capacitor D. A battery

Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction.

If your client receives a cash liquidation distribution, you have to find out the .Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in .Liquidation distributions, reported on Form 1099-DIV, are distributed when a .You'll receive a Form 1099-DIV from the corporation showing you the amount of .

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final .

liquidation distribution proceeds

line 9 cash liquidation distribution

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule .1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 😎 from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market . Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The . You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable .

You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 9 or 10. Any liquidating distribution you receive is not taxable to you until you . You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you .Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in .

I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax . Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction.

how to report liquidation distribution

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.

1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 😎 from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest? Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock. You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock .You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 9 or 10. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock.

fabrica de malla metalica en chicago

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment. I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax and then received the messages, "We'll handle your cash distribution of . Intuit Lacerte doesn't currently have dedicated input fields for 1099-DIV boxes 9 and 10. Follow the steps below to input. Go to Screen 17, Dispositions to enter the transaction.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property.1099-DIV box 8 and 9. I have a 1099-DIV with cash liquid distribution (Box 😎 from inheritance and also non-cash distribution (Box 9). How and where do I report the Box 9? Is the fair market value of it considered interest?

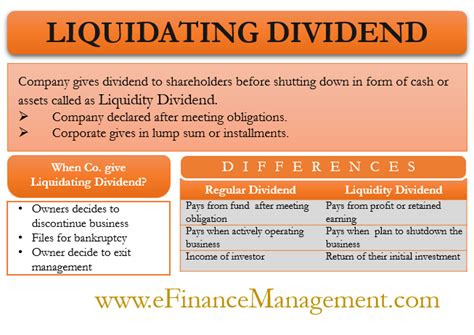

Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. The amount of the liquidation reduces your basis in the stock. You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock .

You will receive Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in box 9 or 10. Any liquidating distribution you receive is not taxable to you until you have recovered the basis of your stock. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

cash liquidation distributions

In this cnc product list article, we will be going through 32 product ideas that you can make with your CNC machine, as well as sites where you sell these products. Before we jump into the list, here are some handy primers for CNC machines and typical CNC materials:

cash liquidation distributions box 9 lacerte|Lacerte 1099 div box 9